The numbers don’t lie - accountant ‘follows the money’ to find where the TAB went wrong

An accountant who worked at the TAB for 16 years has crunched the numbers, pinpointed where it all went wrong, and concluded only further Government support can keep the racing industry alive.

Peter Johnstone, who was manager of strategic planning for the TAB, did a lot of data analysis and acted as secretary of John Falloon’s Ministerial Committee in 1991, says if you “follow the money” you can better understand the sad decline of an organisation he once proudly worked for.

“The best way to do this in my experience is to look at an organisation’s cash flow statements which I view as superior to all other financial statements for a firm.

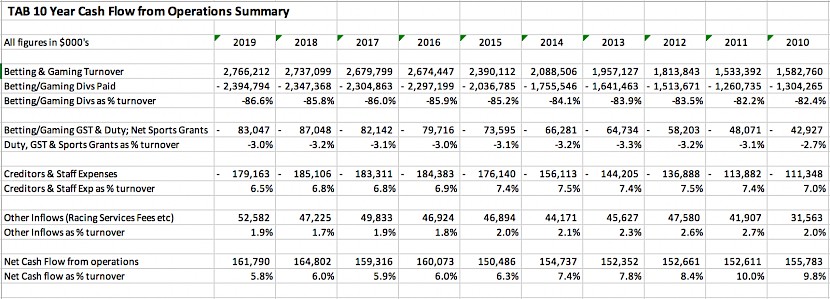

“The single factor that really struck me is that over the last 10 years, cash flow from operations increased by only $6 million (just under 4%), despite turnover increasing by $1.183 billion (up 33.7%).

“This is the key to understanding how it has all gone so wrong.

“Many commentators say that costs are out of control, pointing to the increase in payroll costs, yet compared with turnover, they are lower as a percentage than they were 10 years ago, and are actually an identical percentage to 2001 (2.2%).”

Lincoln Farms’ May 9 feature moved Johnstone to delve a little deeper into the published financial information of the New Zealand Racing Board and Racing Industry Transition Agency.Johnstone says while Lincoln Farms’ feature story ‘An A to Z of what brought racing to its knees’ explains a great deal about what went wrong in the current century - particularly the high turnover of chief executives and some of the disastrous decisions they made - cash flow from operations shows the real health of an organisation.

Lincoln Farms’ May 9 feature moved Johnstone to delve a little deeper into the published financial information of the New Zealand Racing Board and Racing Industry Transition Agency.Johnstone says while Lincoln Farms’ feature story ‘An A to Z of what brought racing to its knees’ explains a great deal about what went wrong in the current century - particularly the high turnover of chief executives and some of the disastrous decisions they made - cash flow from operations shows the real health of an organisation.

“Strong operational cash flows allow a firm to fund capital projects and distribute funds to stakeholders such as shareholders (or in the case of the TAB, to the racing industry and latterly sports bodies). They also minimise the need for any borrowing and consequent interest costs.”

In 2010, cash flow from operations was $155.8 million, or 9.8% of turnover (and even better in 2011 at 10%). By 2019, this was down to 5.8% which equated to $161.8 million.

41% decline

“This is a decline in the rate of return of almost 41% in a decade. Put another way, had the TAB been able to maintain the 9.8% proportion, operational cash flow last year on the same turnover would have been $271.1 million, roughly $110 million more than it actually was.

“And in that case, very few of the current problems would be apparent. Racing industry returns could have been hugely improved, and capital expenditure may have been funded without the borrowing and asset sales the TAB has had to fall back on.”

Johnstone says Lincoln Farms’ recent interview with Ken Rutherford helped explain the drastic decline.

“Rutherford said he could never understand why a succession of TAB chiefs placed such an emphasis on promoting fixed odds betting when the product at best realised half of the 16.5% of tote betting income.”

In 10 years the TAB’s cash flow from operations increased by only $6 million (just under 4%), despite turnover increasing by $1.183 billion (up 33.7%).In his analysis of the cash flows for the last 10 years (see chart above) Johnstone discovered clearly the biggest change has been in dividends from betting and gaming.

In 10 years the TAB’s cash flow from operations increased by only $6 million (just under 4%), despite turnover increasing by $1.183 billion (up 33.7%).In his analysis of the cash flows for the last 10 years (see chart above) Johnstone discovered clearly the biggest change has been in dividends from betting and gaming.

The dividends the TAB paid out in 2010 were 82.4% of turnover and last year that had grown to 86.6%.

“The change doesn’t look that bad on the face of it, but when you consider that is a deterioration of 4.2 cents from every dollar the TAB has handled, it is hugely significant.

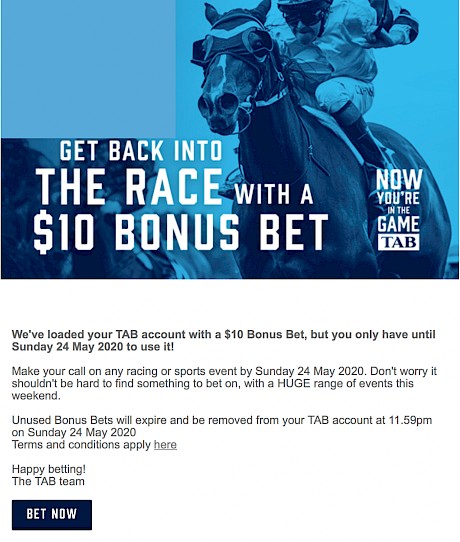

Bonus bets have contributed to a reduction of the TAB’s profit margin.“While it’s a little hard to isolate all the causes, we can surmise they include:

Bonus bets have contributed to a reduction of the TAB’s profit margin.“While it’s a little hard to isolate all the causes, we can surmise they include:

* Driving fixed odds betting at the expense of tote betting

* The fickleness of sports betting, the profitability of which can often depend on results going the TAB’s way.

* The impact of bonus bets - “which I never understood the rationale for, given the TAB was always a low margin business.”

* The loss in turnover of easybets - “a subject dear to my heart as along with Alan Mayo I developed the original spec for easybets, which attracted the most favourable rates of commission.”

Johnstone says the small gains from a much higher revenue is like the TAB baked a 40% bigger pie, but put only another 6% of steak in it.

“I find it absolutely incredible that the TAB increased turnover by so much for so little gain.

“What I believe they should have done was to focus on maintaining a healthy margin on every dollar bet, rather than growing turnover at minimum benefit to cash flow or the bottom line.

“You could conclude that had turnover not been increased so greatly there may have been less profit, but even on a $2 billion turnover, the old margins would still have increased operational cash flow by some $34 million, and presumably also produced lower costs.

“Of course, you can’t discount the issue of costs entirely - with increased automation and superior software tools, you’d expect improved productivity and lowered costs.

“However, in general the ratios suggest that the TAB have been effective in controlling costs - in the last 10 years staff and supplier payments fell from 7% of turnover to 6.5%, after reaching highs of 7.5%.”

The Jackson Street building was purpose built for the New Zealand Racing Board in 1989 but in August, 2014 it was syndicated by the Oyster Group and the TAB now leases its space.Property sales

The Jackson Street building was purpose built for the New Zealand Racing Board in 1989 but in August, 2014 it was syndicated by the Oyster Group and the TAB now leases its space.Property sales

Johnson is critical of the TAB’s handling of its properties in the last 10 years - notes to the financial statements showing buildings in Petone, Christchurch and Auckland all being sold.

“Though I can’t identify all the assets that have been sold the cash flows indicate that $21.3 million was received from the sale of property, plant and equipment and the TAB no longer owns any buildings.

“Presumably, these facilities (or their replacements) are why the TAB’s lease/premises costs have gone from 2010’s $4.7 million to 2019’s $14.3 million.

“While there are costs associated with owning properties, in most commercial leases many of these costs are assumed by the tenant. The decision to divest these properties makes no sense, since it has exposed the TAB to incurring rentals in perpetuity, which must cost more than retaining them.”

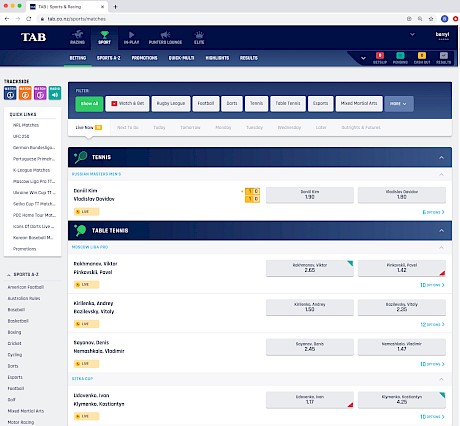

The TAB spent $42 million building its new betting platform, to attract sports punters, and it has an annual ongoing cost of $17 million.Capital spending

The TAB spent $42 million building its new betting platform, to attract sports punters, and it has an annual ongoing cost of $17 million.Capital spending

Johnstone says a further area of concern highlighted by the TAB’s cash flow statements is the level of capital spending.

Over 10 years this has amounted to almost $207 million, with almost $72 million in the 2018 and 2019 financial years.

“This has to be funded by cash flow from operations unless money is borrowed, which has been a necessity in the last two years.”

Johnstone says while he’d need access to much more information than is available publicly, you’d have to question the new $42 million betting platform, of which both Lincoln Farms and Rutherford have been outspoken critics.

“I was especially troubled by Lincoln Farms’ revelation that the TAB has locked itself into an annual licence fee of more than $17 million, in addition to the substantial capital cost.”

Johnstone says what is especially depressing about this is the TAB’s development team in the 1970s, 80s and 90s had exceptional skills.

“They developed a world class betting system largely in-house, with the assistance of a few key contractors. Under manager Mike Thornbury the team delivered great solutions and seemed capable of solving every issue they were confronted with. And the computing environment and tools they had to work with were primitive compared with today.

“I can’t help but wonder what happened to that level of expertise and skill, that an organisation that could build Jetbet now relies on external software providers at the cost of an arm and a leg.”

Like Ken Rutherford, pictured, Johnstone experienced an erosion of the TAB culture.Erosion of culture

Like Ken Rutherford, pictured, Johnstone experienced an erosion of the TAB culture.Erosion of culture

Johnstone said just as Rutherford described an erosion of the culture he experienced at the TAB when head of sports betting (in his interview with Lincoln Farms), he too experienced the change and was happy to move on during the first wave of redundancies in 1993.

“Rutherford talked of the external executives that have regularly come and gone, and their failure to truly understand the drivers of wagering.

“I can only conclude that the “old” TAB culture I revered was in many ways superior. People were well paid, yes, but not compared with the exorbitant packages of today.

“More importantly, I think, there was much less external recruiting - the majority of appointments were internal, and thus people in most roles were thoroughly conversant with the culture, they certainly understood wagering, and they knew the strengths and weaknesses of their colleagues.

“Maybe there was an element of “time serving” in some cases, but most of the people I worked with cared deeply about the industry and the role they played within it. I’m certainly not convinced that the change has been beneficial, and the financial evidence would seem to bear that out.”

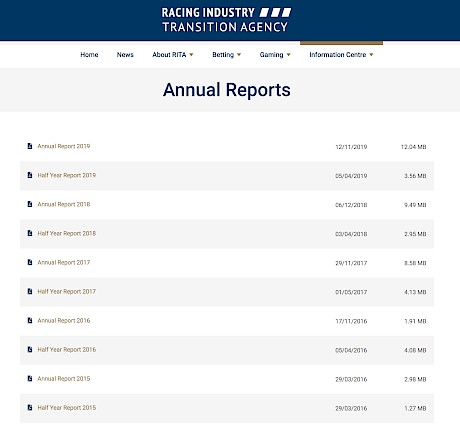

Most of the TAB’s half yearly reports in the last two decades have been delivered in March, and the latest was on May 1, in 2017. A $3.2 million blunder with bonus bets delayed this year’s report and it has still not been published. “It must be truly dreadful to remain hidden from public view,” says Johnstone.COVID accelerator

Most of the TAB’s half yearly reports in the last two decades have been delivered in March, and the latest was on May 1, in 2017. A $3.2 million blunder with bonus bets delayed this year’s report and it has still not been published. “It must be truly dreadful to remain hidden from public view,” says Johnstone.COVID accelerator

Johnstone says rather than COVID-19 being responsible for the TAB’s current troubles, it has merely accelerated the day of reckoning.

“It had to be coming anyway. The 2019 annual report already showed an organisation that was technically insolvent, with $35 million of borrowings (after never being in a position where it showed end of year borrowings before 2018).

“For the third year in a row, total cash flow for the organisation was negative, and total equity had fallen to less than $25 million, whereas in the late 2000s it had exceeded $100 million.

“In this light it is notable that RITA’s website still has no six monthly report for the current year. It is now weeks overdue and my guess is that it must be truly dreadful to remain hidden from public view.

“The government recently “saved” the TAB and hence the racing industry with a multi-million dollar bailout.

“But in view of what I can see from the publicly available figures, I question whether this will be enough. With many of the TAB’s recently announced cost cutting measures potentially threatening to further erode the turnover base (especially in the biggest revenue generator of racing) the industry will remain in a parlous situation for the foreseeable future and it would seem that only continued government support will keep it alive.”

It’s a far cry from the days when Johnstone was responsible for investing the TAB’s profits in the money markets.

“There used to be a torrent of cash in those days and it was when we earned interest rates of 20% plus.”

More news in Gallops

Hawk will need the run but don’t poo-poo the form from the Castlepoint Beach races

Visor blinkers switch on Lincoln King in hard-fought first hurdles win at Ballarat

Promising pair extend picket fence form lines but soon to go into winter quarters

Atta boy Billy, your timing to erase the recent pain was brilliant - and so was Opie’s

Our runners this week

Saturday at Wanganui

Our runners this week: How our trainer rates them

Lisa’s comments

Thursday at Otaki

Race 7: Lincoln Falls

4.23pm

“I thought it was a great run at Otaki where he was beaten on the line coming off a one week back-up. He sets up a lot nicer here with 12 days between races. He came through that last run really well and drops down to 53kg. Ace Lawson-Carroll should be able to get into a nice position from the six draw and I wouldn’t be surprised to see him right in the finish again.”